Computer fixed asset depreciation

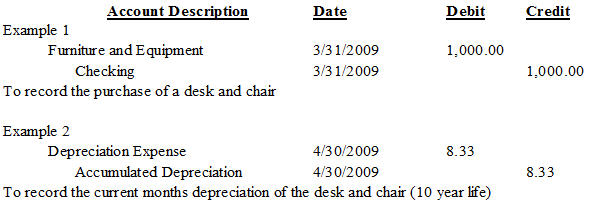

Accumulated depreciation is the credit account in the balance sheet under the fixed assets section. Select Chart of Accounts.

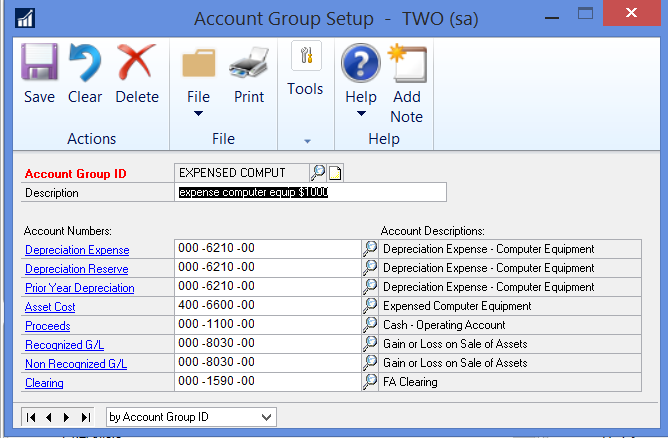

You Should Be Using Fixed Assets In Dynamics Gp

It is used to record all depreciation expenses up to the reporting date.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year you place the computer in service if you dont elect to expense any of the cost under section 179. From the Detail Type dropdown choose. From the Account Type dropdown select Tangible Assets.

Depreciation rate finder and calculator. For instance a widget-making machine is said to depreciate. Ad Fixed Asset Pro Is Continually Updated For The Latest Changes In Tax Depreciation Rules.

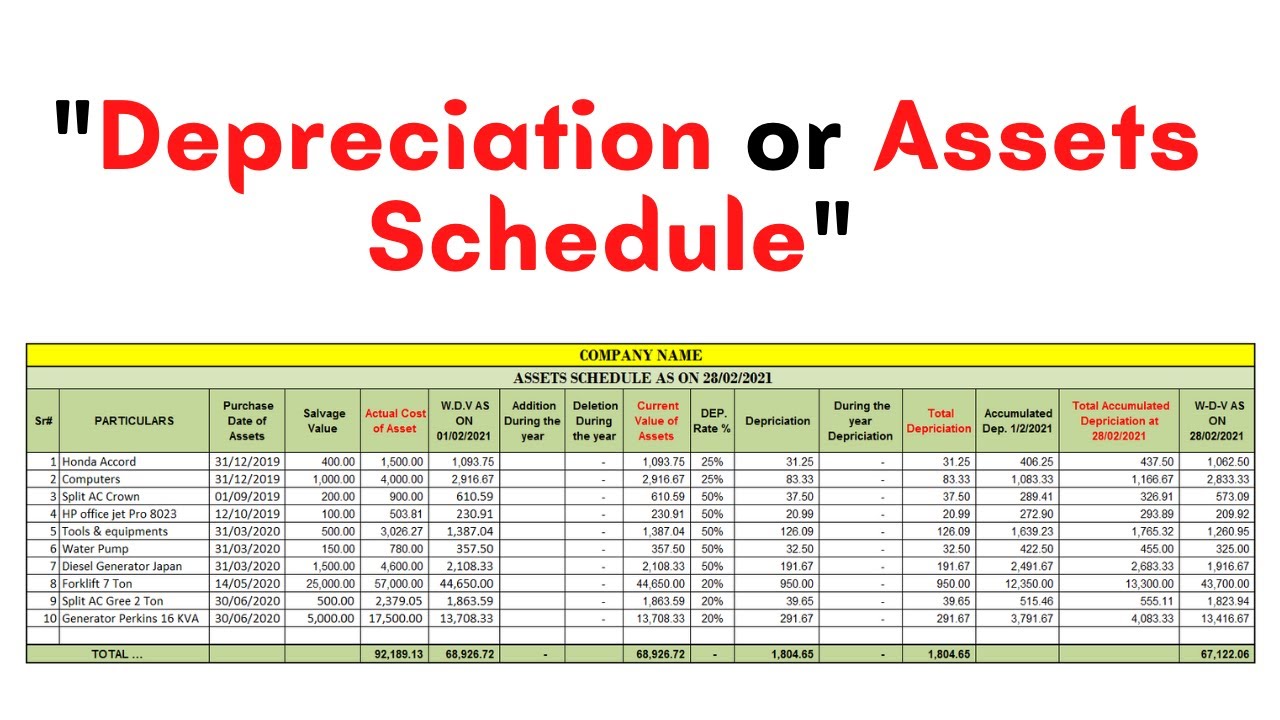

You can use this tool to. Find the depreciation rate for a business asset. Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet and is charged as an expenditure to a profit and loss account.

Use our automated self-help publications ordering service at any time. Calculate depreciation for a business asset using either the diminishing value. Tools equipment and other items such as computers and books are depreciating assets.

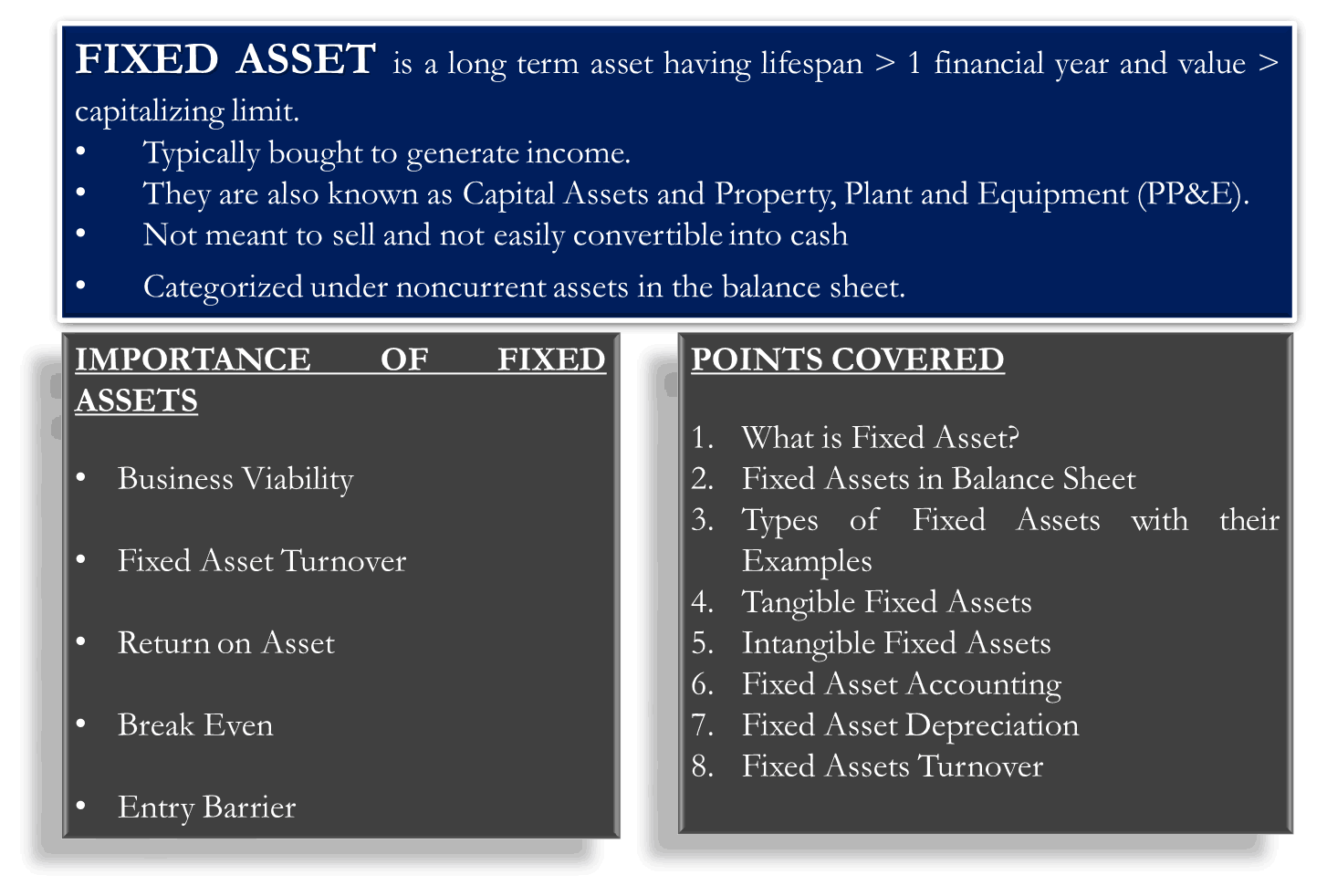

This limits your tax burden and company losses. Fixed assets also known as tangible assets or property plant and equipment PPEis an accounting term for assets and property that cannot be easily converted into. All-In-One System For Fixed Asset Depreciation Accounting Management And Reporting.

You need to know the full title Guide to depreciating assets 2022 of the publication to use this service phone our. It is obtained by multiplying the straight-line depreciation rate by a coefficient. Go to the Accounting menu.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Get Full Visibility Of Your Equipment Assets on a Single Dashboard with Verizon Connect. To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using.

The value of the coefficient depends on the duration of use and the nature of the equipment. Depreciation is an accounting practice that spreads the loss of value for each of your assets over multiple accounting periods. You can claim a deduction for the decline in value of depreciating assets you buy and use to earn your.

You can record fixed assets in a computer system which will usually calculate depreciation and gains or losses from disposal or you can track them manually in a. Ad Track Analyze All Your High-Value Assets and Equipment with One Powerful Solution.

The Basics Of Computer Software Depreciation Common Questions Answered

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet

Fixed Asset Register Depreciating Your Assets What You Need To Know

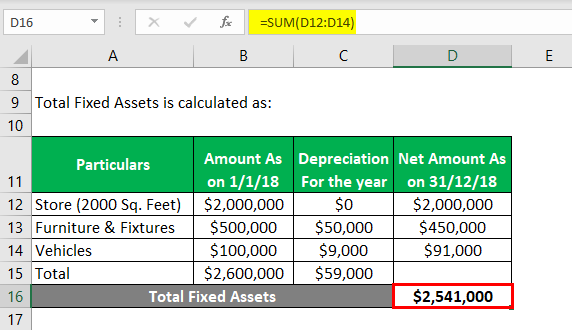

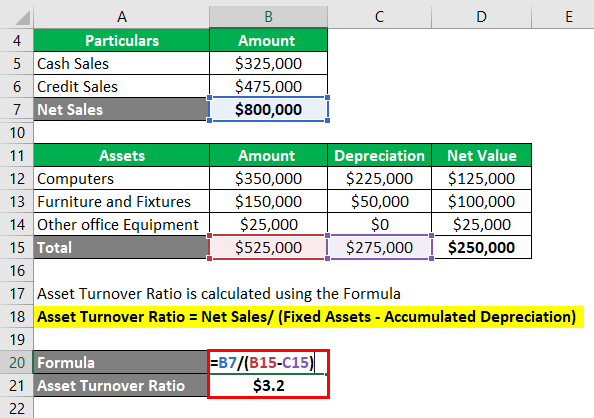

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Fixed Asset Journal Entries Depreciation Entry Accumulated Depreciation Youtube

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Fixed Asset Register Depreciating Your Assets What You Need To Know

Fixed Asset Inventory Report Depreciation Guru

Depreciation Nonprofit Accounting Basics

Solved Entering Transaction For Fixed Asset Purchase

What Is Fixed Asset Type Tangible Intangible Accounting Dep

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

How To Prepare Depreciation Schedule In Excel Youtube

Computer Software Depreciation Calculation Depreciation Guru